Net Absorption

Retail net absorption was slightly negative in New York City first quarter 2017, with negative (54,419) square feet absorbed in the quarter. In fourth quarter 2016, net absorption was negative (37,262) square feet, while in third quarter 2016, absorption came in at positive 560,933 square feet. In second quarter 2016, negative (157,549) square feet was absorbed in the market.

Tenants moving out of large blocks of space in 2017 include: Room & Board moving out of 30,500 square feet at 105 Wooster St; and Harlem NYC moving out of 30,000 square feet at 256 W 125th St.

Tenants moving into large blocks of space in 2017 include: Bed Bath & Beyond moving into 20,361 square feet at 5 W 125th St; TJ Maxx moving into 20,000 square feet at 5 W 125th street and Bed Bath & Beyond moving into 20,000 square feet at 2431 Broadway.

Vacancy

New York City’s retail vacancy rate increased in the first quarter 2017, ending the quarter at 4.1%. In prior quarters, the market has seen an overall increase in the vacancy rate, with the rate going from 3.7% in the second quarter 2016, to 3.5% at the end of the third quarter 2016, 3.8% at the end of the fourth quarter 2016.

The amount of vacant sublease space in the New York City market has trended up over the past four quarters. At the end of the second quarter 2016, there were 44,053 square feet of vacant sublease space. Currently, there are 88,375 square feet vacant in the market.

Largest Lease Signings

The largest lease signings occurring in 2017 include: the 47,286-square-foot-lease signed by Nordstrom Rack at 855 Avenue of the Americas; the 39,821-square-foot-deal signed by Target at 111 W 33rd St; and the 30,045-square-foot-lease signed by Town Sports International at 2 Astor Pl.

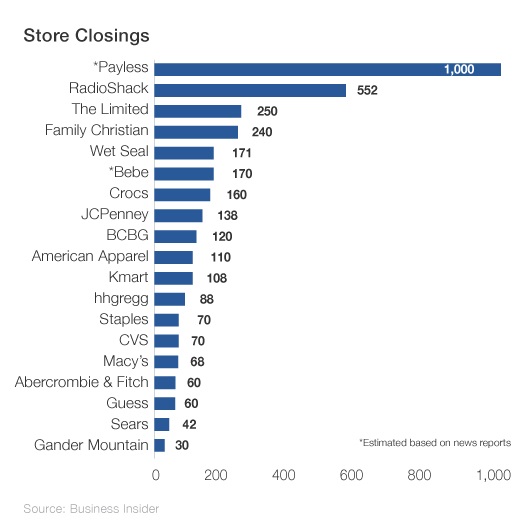

Nationwide Store Closings

Over the next 2 quarters several big chain retail companies have annouced the closing of over 3500 retail outlets throughout the country.